Proposed Changes Would Help Meet Demand

Novogradac Estimates 200,000 New and Preserved Homes Over the Next Ten Years

By Nushin Huq

7 min read

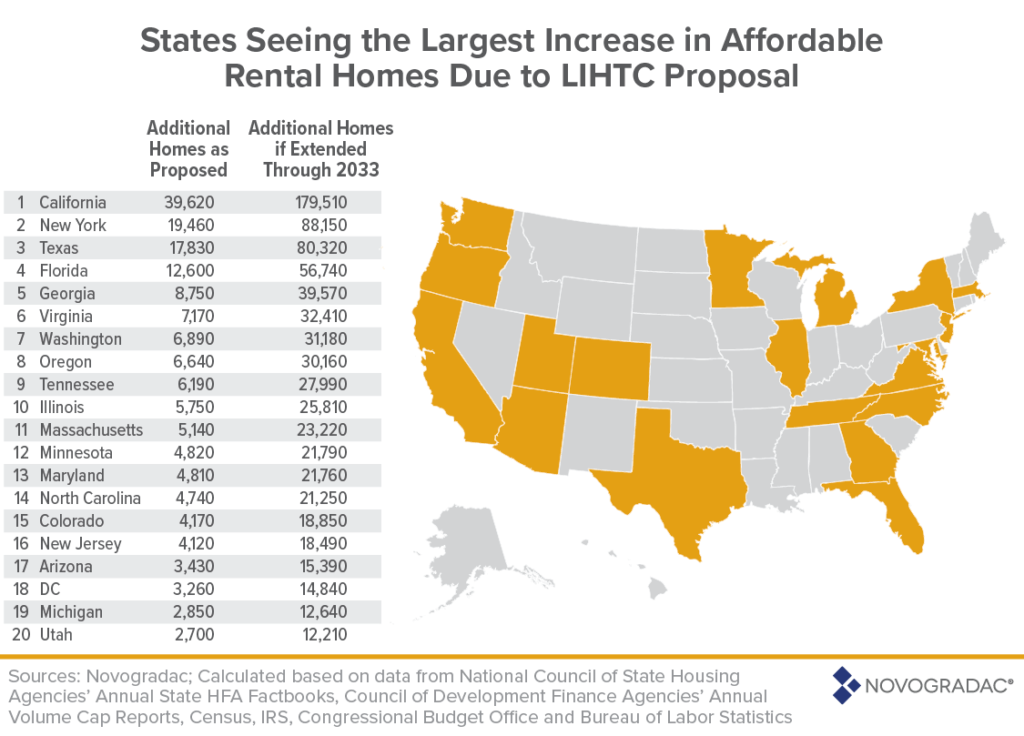

Two proposed changes in tax legislation pending in Congress could increase the number of new and preserved affordable rental homes coming to market in the next ten years by over 200,000, according to consulting and accounting firm Novogradac.

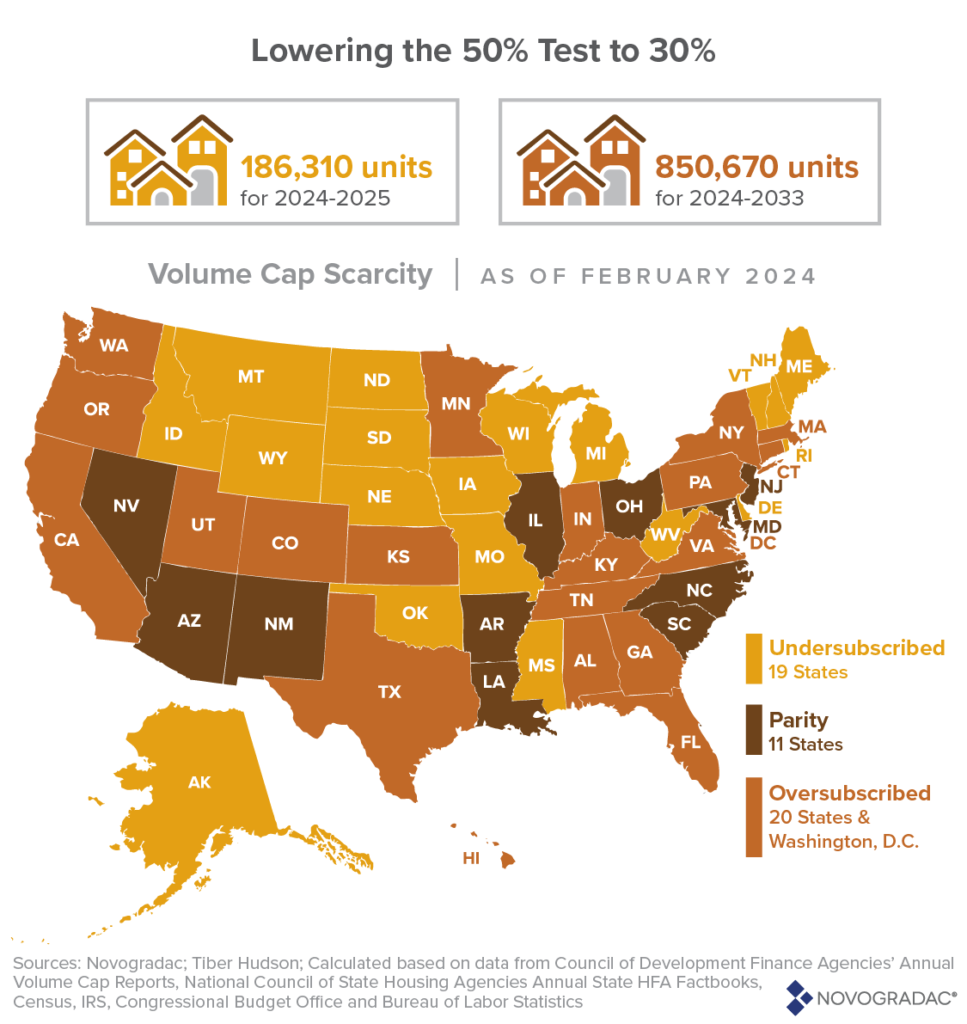

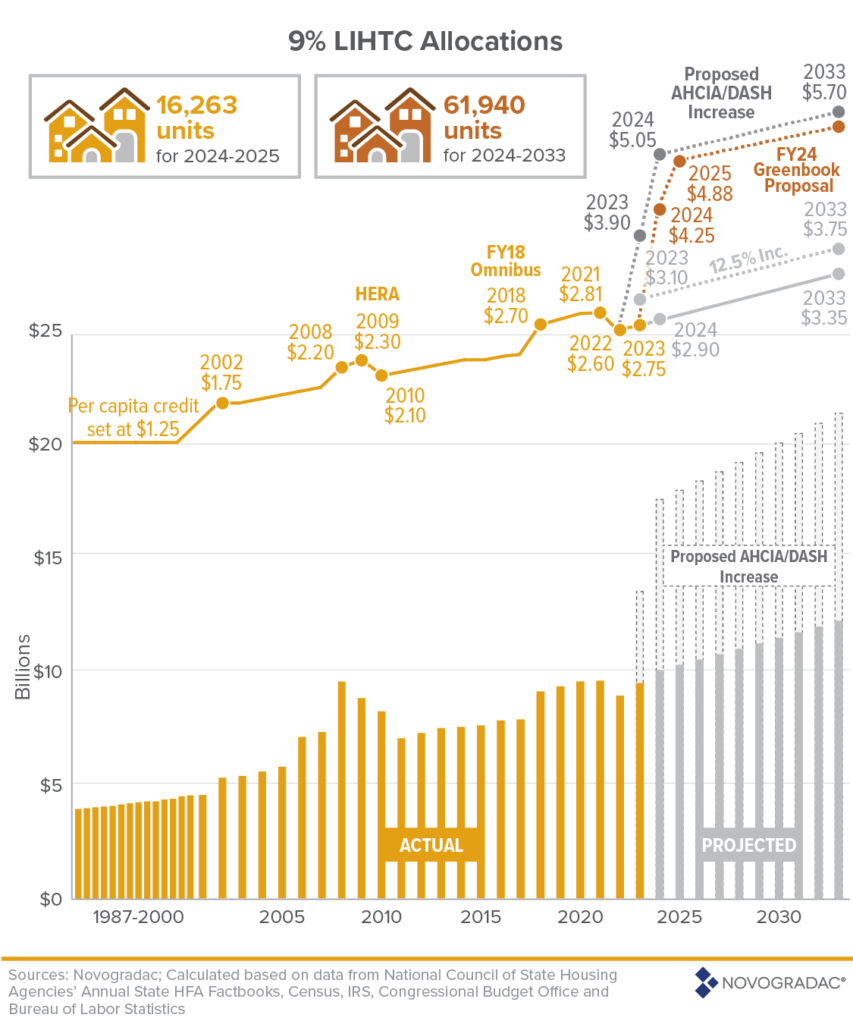

Proposed changes would be restoring the 12.5 percent allocation increase for 2023 through 2025 for the nine percent tax credit allocation and lowering the 50 percent private activity bond financing threshold to qualify for four percent tax credits from 50 to 30 percent for 2024 and 2025. Novogradac estimates the 12.5 percent allocation increase would finance the creation and preservation of an additional 16,263 affordable rental homes, and changes in the private activity bond threshold would finance the creation and preservation of an additional 186,310 affordable rental homes over ten years totaling an additional 202,573 new and preserved affordable rental homes.

While the affordable housing industry has been advocating for these changes for a long time, the most recent proposals were included in the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024). In addition to tax provisions that address affordable housing, the comprehensive bill also includes provisions related to the Child Tax Credit, disaster tax relief and extending business tax provisions.

Novogradac Estimates

Lowering the private activity bond threshold will be a significant provision to help in many states, says Peter Lawrence, director of public policy and government relations at Novogradac. Currently, in 19 states plus the District of Columbia, demand for private activity bond allocations is higher than the amount available in the state, and those states have the most to gain with a lower threshold.

“From a state perspective, they’re wasting their valuable private activity bond cap,” Lawrence says. “Putting in more debt than is needed for that property, so they can’t use bond cap for other purposes.”

It’s also inefficient from a developer perspective because they typically are paying the bond issuance costs, and those costs are driven by the size of the bonds – the larger the bonds, the more they must pay for the issuance. Furthermore, the bonds are typically paid off after the property is constructed, resulting in refinance costs. Lowering that threshold could finance the creation and preservation of an additional 186,310 affordable rental homes.

To calculate the additional affordable rental homes the proposal would add to the market, Novogradac began with how much states in recent history have allocated for bonds and how many bonds per unit the state uses, Lawrence explains. Then, they calculated what the impact of inflation would be over time, both positive and negative.

“With inflation, states get more tax credit and private activity bond volume cap,” Lawrence says. “But it also costs more per unit to construct. We combine both those impacts into the model.”

Other factors and assumptions modeled into the estimate include interest rates and population changes. Increased interest rates make private activity bonds more valuable because the tax exemption for interest income enables investors to offer that capital at a lower rate and therefore a lower interest rate.

“During the depths of the pandemic, when interest rates were extraordinarily low, there wasn’t much of a difference between taxable debt and tax-exempt debt,” Lawrence says. “That’s not the case anymore, so there’s a benefit there.”

On the other hand, the increased interest rates also change how much debt a property can support. It can support less debt because increased payments mean the rental income doesn’t go as far as it used to to cover that debt.

“It’s not an exact science,” Lawrence says. “We have to make a number of assumptions, but we think it’s reasonably informed given the recent history in each of these states.”

The provision is effective for buildings placed in service after Dec. 31, 2023. For rehabilitation expenditures, which are treated as a separate new building by the Low Income Housing Tax Credit statute, the building is considered placed in service at the end of the rehabilitation expenditures period, according to the section-by-section summary. The 30 percent requirement is applied to the aggregate basis of both the existing building and the rehabilitation expenditures.

Historically, 65 percent of rental homes financed with the four percent LIHTC are preserved while 35 percent are new construction, according to Novogradac.

Increasing Nine Percent LIHTC Allocations

Novogradac also estimates the nine percent allocation increase included in the bill would finance the creation and preservation of an additional 16,263 affordable rental homes.

Congress previously increased the nine percent LIHTC ceiling by 12.5 percent in calendar years 2018 through 2021. The proposal would restore the 12.5 percent increase for calendar years 2023 through 2025 and would be effective for taxable years after Dec. 31, 2022. Because states cannot make allocations in 2023 and the law allows states a carryover authority for one year, the provision would essentially allow a state to have a 25 percent increase in nine percent allocations for 2024. Some states forward allocate their credits, so the actual increase by state would vary.

“The nine percent credit is used more often for new construction as opposed to preservation,” Lawrence says. “Our argument is Congress can’t let this sort of cut be sustained given what’s happening in affordable housing.”

Construction of new homes decreased dramatically during the pandemic and since, especially in rural areas. Allowing the 12.5 percent increase to remain expired was a cut to affordable housing production, Lawrence says.

In calculating additional homes with the proposed increase, the first thing to note is that the nine percent tax credit is used for new construction, Lawrence says. The majority, about 75 percent, of rental homes financed with the nine percent LIHTC are new construction, and the other 25 percent of rental homes are preservations.

“There’s remarkable stability over several years in the fact that pretty consistently about 75 percent of all nine percent allocations go for new construction, and 25 percent for preservation in recent years,” Lawrence says. “You increase the number of allocations by 12.5 percent, you get 12.5 percent more homes.”

Additionally, Novogradac’s model factors in inflation, which affects the nine percent credit in two different ways. First, inflation increases the per capita small state minimum allocation based on the chained consumer price index, or C-CPI. It also affects the amount of credits needed per unit.

“Construction cost inflation has largely exceeded chained CPIs,” Lawrence says. “The dynamics are that you typically get, all things being equal, fewer units each successive year.”

Beyond 2025

As currently drafted and assuming it is enacted, both LIHTC provisions will expire in 2025 if Congress doesn’t act to extend them then.

Along with LIHTC provisions, about 30 other tax provisions from the Tax Cuts and Jobs Act also expire in 2025, which means that Congress will most likely consider a large tax bill in 2025 and make it a priority, Lawrence says. How that bill is shaped will largely depend on the outcome of the 2024 election.

In addition to the impact of LIHTC provisions, the biggest takeaway for the industry regarding the bill’s provisions is that advocacy matters, Lawrence says.

“At the beginning of January, we were not in the legislation, and it took lots of advocacy throughout January to get where we are,” Lawrence says.

He also cautions against complacency and urges stakeholders to continue advocating for these provisions in the Tax Relief for American Families and Workers Act of 2024.

“This is not a done deal,” Lawrence says. “The Senate is not yet fully engaged. They haven’t yet decided how they’re going to address this tax bill. I want to urge people to continue to advocate with their senators to make sure the bill does still get considered and that the housing credit provisions are still included with it.”