Meeting the Housing Needs of Low-Income Americans, Seniors Requires More Resources

By Kaitlyn Snyder

7 min read

Seniors don’t just need a bigger slice, they need a bigger pie

On April 29, 2016, President Barack Obama issued a proclamation designating May 2016 as Older Americans month. Shortly thereafter, the White House held a meeting with affordable housing and senior advocates to celebrate the proclamation and consider what else the Obama administration could do to make housing more affordable for seniors.

Many meetings with congressional and administration staff blur together – advocates repeatedly bring up the same issues and staffers more or less respond with the same pleasantries of ‘thank you for bringing this to my attention’ and ‘we’ll look into it.’ This one, however, stands out. But first, some history for context.

Sequestration

The Budget Control Act of 2011 forced Congress to reach agreement on federal spending levels or draconian budget cuts would automatically take effect in absence of a deal. These budget cuts were always meant to be the doomsday device that forced parties to the negotiating table. But history had other plans. Sequestration did take effect, albeit in a limited way. For the past ten years, congressional negotiators were able to reach across the aisle to agree on short-term deals to raise the budget caps, but the starting point for the negotiations was always the drastic sequestration caps, as set by the Budget Control Act of 2011, instead of historical funding levels.

Outside of the Low Income Housing Tax Credit (LIHTC), the U.S. Department of Housing and Urban Development’s (HUD) Section 202 Housing for the Elderly program has been the primary means by which we develop and rehab affordable housing for seniors in this country. Section 202 funds both Project Rental Assistance Contracts (PRACs) (long-term operating subsidies to senior housing providers) as well as Capital Advance and Expenses. The Section 202 program is one of the few programs at HUD, which funds capital costs, along with its counterpart Section 811 Housing for Persons with Disabilities.

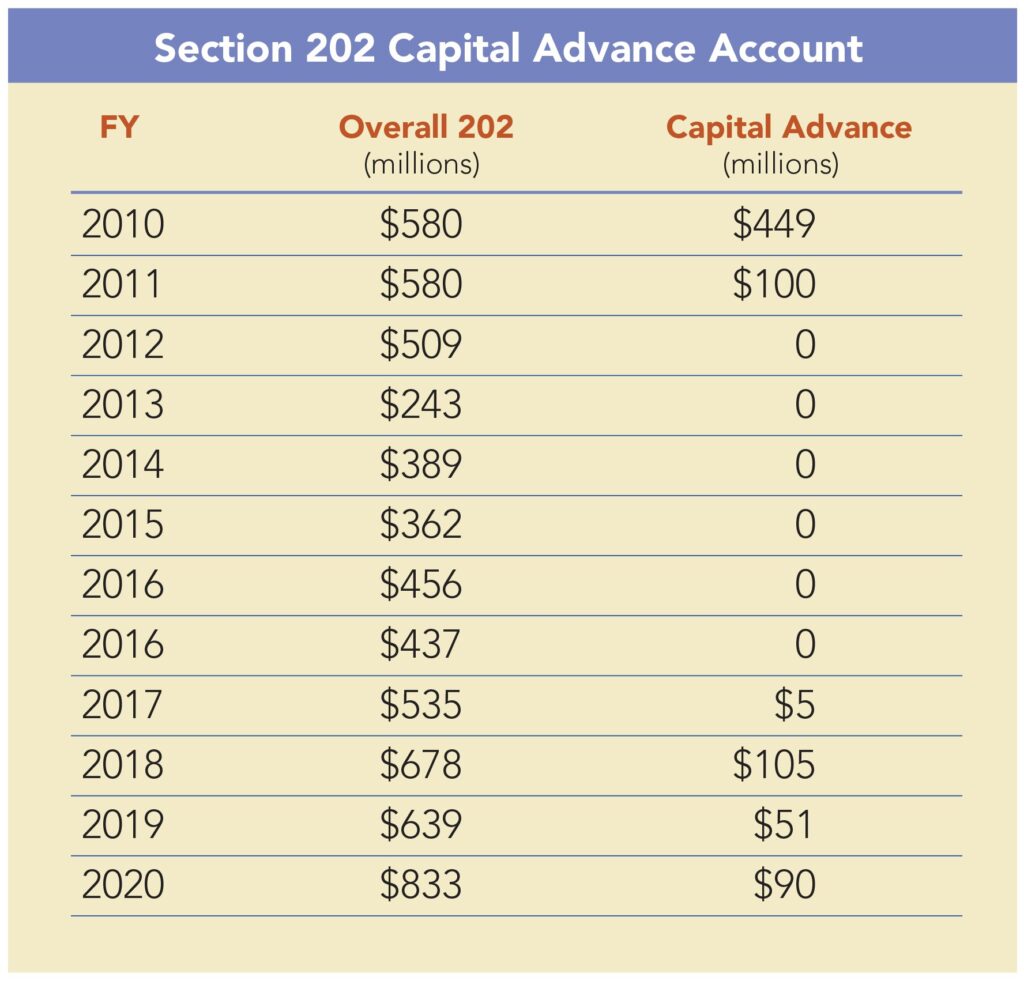

In Fiscal Years (FYs) 2010 and 2011, the Obama administration did not request funding for Section 202 Capital Advance, but Congress decided to fund the account despite the administration’s (lack of) request. Then sequestration took effect and the Capital Advance account was zeroed out in order to maintain the existing PRACs.

During the June 2016 meeting, the Obama administration brought together policy advocates to try to solve the uncrackable nut of insufficient affordable senior housing supply. Linda Couch, vice president of housing policy with LeadingAge, pointed out that the Capital Advance account of the Section 202 program had gone unfunded for several years and perhaps, the administration should start with proposing funding for an account that was zeroed out on its own watch. You could have heard a pin drop in the gaping silence that followed.

As the budget chart on page 21 demonstrates, the advocacy of Couch, LeadingAge and many others was effective. Slowly but surely funding for the Section 202 Capital account ticked upwards and another Notice of Funding Availability (NOFA) was just released by HUD earlier this month for the new Capital Advance funding.

Beyond Section 202 Capital Advance

In 2018, Congress expanded the successful Rental Assistance Demonstration (RAD) to allow Section 202 properties to convert from PRAC to the Section 8 platform and leverage private capital for the much-needed repairs. RAD for PRAC is off to a promising start, having closed its first deal last month – see Mark Fogarty’s case study in this issue. Tom Davis, director of HUD’s Office of Recapitalization, and his team are making a few process improvements now that the first transaction has closed, mainly around standardizing form documents, ensuring clear communication between their office, the regional HUD office and the developer and training owners on the setting of rents – see “It’s Very Clear, This RAD is Here to Stay” in the April 2019 issue for more on rent setting.

More than 150 Section 202 properties are already in the conversion pipeline and many more are expected. Some 2,800 properties with 120,000 units were placed in service between 1993 and 2018 with Section 202 Capital Advance funding. Many of the new Section 202 properties built with the recent Section 202 Capital Advance NOFA funding are expected to immediately go through the RAD for PRAC conversion process to get onto the more stable Section 8 funding platform.

Meeting Demand

But the current Congressional funding levels remain woefully inadequate, both compared with the FY 2010 levels and more importantly, to the overall demand for affordable senior housing – see Mark Olshaker’s article on demand in this issue.

Outside of Section 202, LIHTC and Section 8 housing are the primary providers of affordable senior rental housing. Housing credit allocating agencies (HCAAs) are statutorily required to award at least ten percent of their nine percent credits to nonprofit housing providers. The allocation of LIHTCs by HCAAs is done through a point-based, competitive allocation process determined by each HCAA, in which they can incent the development and preservation of senior housing.

Many RAD for PRAC conversions will require the support of LIHTCs to fund the backlog of capital needs of Section 202 properties. Since all Section 202 properties are owned by nonprofit providers, HCAAs may be able to fund RAD for PRAC conversions through the mandatory ten percent nonprofit set-aside. Most QAPs offer points for senior housing, but it represents just one of the many priorities that HCAAs must support. The current supply of credits is inadequate to meet the wide variety of demands and any effort to expand support for one specific type of housing results in a zero-sum game with fewer resources for another type.

Roughly two-thirds of Section 202 properties receive project-based rental assistance through Section 8, with the remaining third receiving PRACs. According to HUD’s Resident Characteristics Report, over a quarter of HUD-assisted residents are over 50 and 15 percent are over 62. Only one-fifth of the households that are eligible to receive assistance actually do so. Each year, Congress struggles to adequately maintain funding levels for currently-assisted households, let alone expand the program’s reach to serve everyone who meets eligibility requirements.

Expanding the Pie

As we think about solutions, the most obvious is to expand the pie to adequately meet the demand of all low-income households, seniors included. In absence of universal funding, bills like the Affordable Housing Credit Improvement Act and Support Allowing Volume Exception for Federally-Assisted Housing Act would expand the resources used to fund the development and preservation of affordable housing.

For far too many, their golden years are mired in abject poverty and homes they’ve lived in for decades become unlivable as mobility and independence decline. Research has consistently demonstrated that intentionally designed housing for seniors, with access to service coordinators, avoids costly higher levels of care and institutionalization.

Roughly half of the Section 202 PRAC properties come with service coordinators who help seniors access resources and services that enable them to live independently with dignity. During the RAD conversion process, the salary for those service coordinators is underwritten into the deal and any Section 202 property currently without a service coordinator is required to fund one.

Connectivity

In our digital COVID-19 world, access to the internet has never been more important. The case study presented in this issue was able to fund hard wiring of Wi-Fi throughout the entire building with a grant from a local bank. And while that’s a successful outcome for those 46 households, it is far from a sustainable, replicable model supported by sound public policy.

According to an October 2020 survey on COVID-19’s impacts on LeadingAge’s affordable senior housing provider members, more than three quarters (84 percent) consider resident social isolation and access to services to be the top challenge in the next three months. Wi-Fi should be considered as essential as service coordinators and electricity. It’s no longer a ‘luxury’ amenity – for seniors it provides vital access to telehealth and is the means by which to maintain social and familial connections during a time when in-person visits are too high-risk, elderly populations are appropriately curtailed.

As we approach the end of the year and the holiday season, I hope there is a lot of pie at your dinner table. But more importantly, I hope seniors get the larger pie that they deserve.