Inside Tackenash Knoll, the Largest Affordable Housing Project on Martha’s Vineyard

New Development Serves as Model for Other Upscale Communities

By Mark Fogarty

9 min read

A project in the exclusive island colony of Martha’s Vineyard, Mass. serves as a replicable model for building affordable housing in upscale resort towns. The development, Tackenash Knoll, is located on the northern side of the island in the town of Oak Bluffs. Tackenash Knoll comes on the heels of a similar affordable project in the Martha’s Vineyard town of Edgartown, called Meshacket Commons, done by the same two co-developers — Boston-based Affirmative Investments and local non-profit Island Housing Trust (IHT).

Groundbreaking for Tackenash Knoll took place on July 17.

“Tackenash is actually the second project for Affirmative and IHT,” says Craig Nicholson, senior vice president at Affirmative. “We broke ground on Meshacket Commons about a year ago, and we purposely reused the building design for the Tackenash development.”

Nicholson says that both projects will provide housing at a critical moment for Martha’s Vineyard. “The Vineyard has really been suffering from a depletion of year round housing,” he says. “A lot of people buying housing make them vacation houses or short-term rentals. It’s been a crisis for the island in decreasing supply and increasing costs for the residents there.”

A Significant and Replicable Impact

The Tackenash project, which will end up providing a total of 60 affordable units, represents the single largest affordable housing development that’s occurred in the history of Martha’s Vineyard, according to Nicholson. Meshacket is providing another 40 units of affordable housing. Both projects span multiple buildings on larger sections of land with the goal of creating a high-density neighborhood feel.

Though Tackenash is slightly larger, Nicholson says that the projects share similar design specifications, allowing for an overall smoother project timeline. “We kept the same general contractor and the same subcontractors, so we’re basically building the same buildings over and over again at these two properties,” he says. “At Tackenash we have 12 residential buildings. Eleven of them are exactly the same design as the eight being done in Meshacket.”

Looking forward, “we would love to replicate as much as we can,” Nicholson says. “It always depends on the land and the scope and the size you can develop. Both of these were luckily rather large developments the towns had.”

Philippe Jordi, chief executive officer of IHT, agrees about the project’s replicability. “This can be a model not just for our island but for others,” he says, mentioning neighboring Nantucket and the Cape Cod peninsula.

The critical component, Jordi feels, “was having the necessary infrastructure to allow higher density development. Both Edgartown and Oak Bluffs have the ability to connect to public water and sewer.”

Mark Teden, vice president of multifamily programs at MassHousing, also feels this type of development could be replicable. “It just needs the subsidy money,” he says. “This could easily be done in other places.”

The development came about after the town of Oak Bluffs put out a request for proposals for a formerly vacant, undeveloped 7.8-acre parcel of land owned by the town. Affirmative and IHT partnered together on an application, and were awarded the project in late 2021. “We applied for funding through the state in February 2023 and were awarded funds at the end of 2023,” says Nicholson. “We worked through MassHousing for the 4 percent tax credits and those became available to us at the beginning of this year.”

The project has about $18.5 million of federal Low Income Housing Tax Credit (LIHTC) equity and $8.7 million of state LIHTC equity, according to Nicholson. Stratford Capital served as the syndicator. “They have a couple of lead investors, Rockland Trust Co. is one of them (they’re also providing our construction loan),” he says. “On the state investment side we went through Clocktower Tax Credits, and Ameriprise Financial is the buyer of the state tax credits.”

Other funding includes $6 million in direct support from the Commonwealth of Massachusetts’ Executive Office of Housing and Livable Communities and $2.5 million from MassHousing for workforce housing. The land is being provided by the town of Oak Bluffs via a ground lease.

“We have a mortgage of about $8.25 million through MassHousing. We have a deferred developer fee of $510,000 and about $4.5 million our co-sponsor has put in,” Nicholson says.

The money from IHT includes $1.75 million in funding from private donations and foundation grants, $750,000 from the town of Oak Bluffs, and a $130,000 grant from Vineyard Power.

Total development cost is $49,936,000.

A Housing Crisis Means Construction Woes

As the housing dynamics on Martha’s Vineyard continue to evolve post-COVID, Nicholson says that long-term housing options have become more scarce. “It is hard for people to get full-year, full-time housing,” he says. “In the offseason people get housing but they are forced to vacate for the summer months. People end up moving every nine months.”

This forces most of the island’s laborers to come from off-island. Though there is hope that the housing provided by Tackenash Knolls may alleviate this issue somewhat, in the short-term, this has caused some immediate challenges for the project’s construction.

“We’ve tried to use local subcontractors as much as possible, but it’s hard to find that level of subcontractors on the island,” says Nicholson. Instead, the project team must often ferry workers, trucks and other equipment to the island, causing logistical headaches. “The subcontractor doing the tree clearing has a three week lead time. There’s a lot of planning to make sure people and equipment show up at the same time,” he says.

This adds a significant cost to construction, with the shuttling process causing an estimated 40 percent premium, according to Teden.

Construction is set for 22 months. Delbrook/JKS is the builder.

Affordable Rents, High Quality Housing

Tackenash “is definitely geared toward family housing,” Nicholson says, with 12 one-bedroom, 42 two-bedroom, and six three-bedroom units. The project will accommodate a wide range of incomes, with nine units designed for families earning below 30 percent Area Median Income (AMI), seven for 50 percent AMI, 27 for 60 percent AMI, nine for 80 percent AMI, and eight for 120 percent AMI.

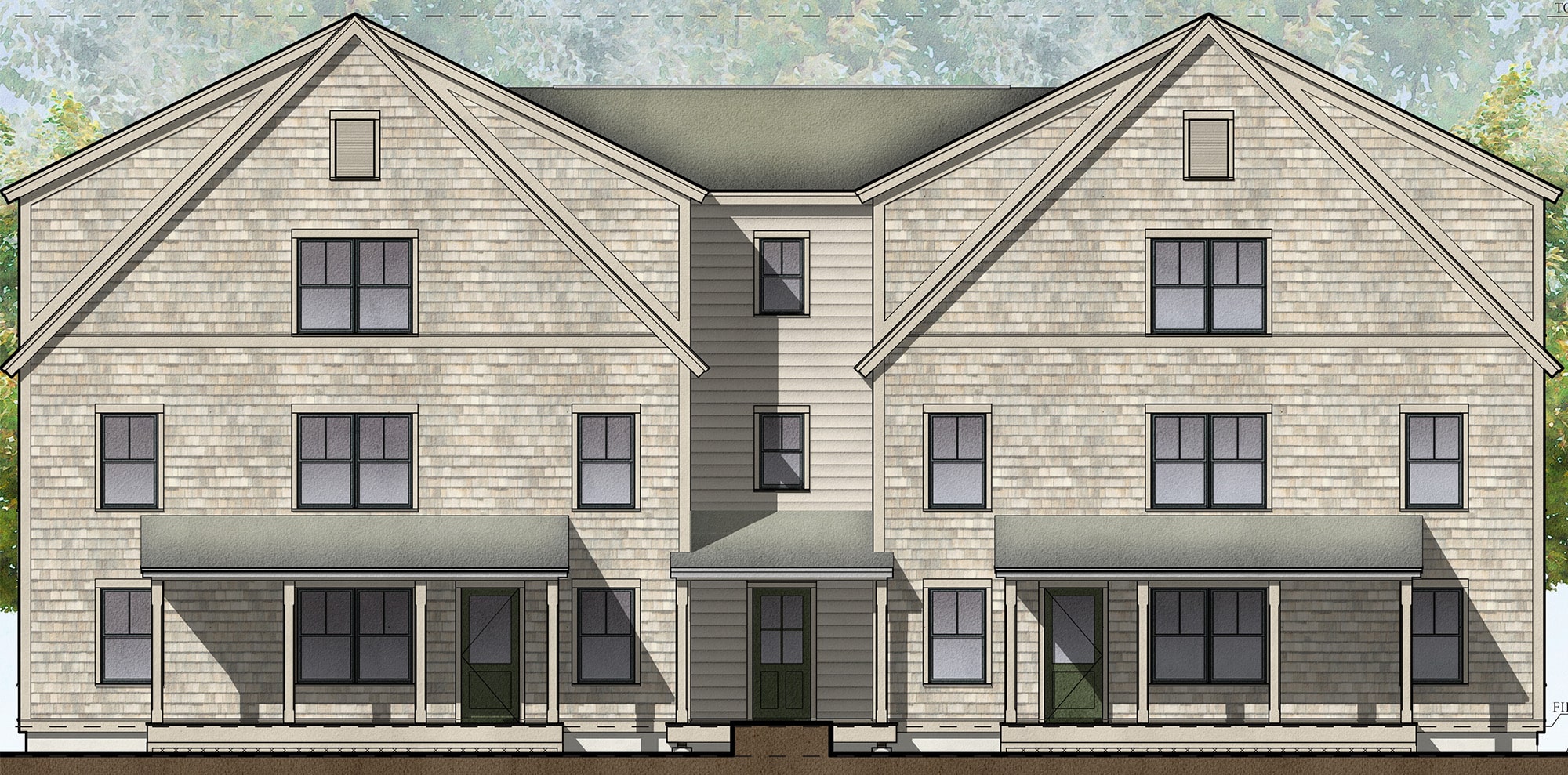

Because of the historic nature of Martha’s Vineyard, it was important for the development team to ensure that Tackenash Knoll conformed with the vernacular architecture unique to the island. Architect Union Studio from Providence, R.I. “completely understood the architectural vernacular of the island — very much that island vernacular of cedar shingles, dormers. It looks like it’s been there forever,” says Nicholson.

The building will be passive house-aligned, with all-electric appliances and solar panels. “We have designed it along the lines of passive housing but we’re not officially certifying. For that many buildings it’s not feasible to officially certify as passive house,” says Jordi. “But we’ve leveraged the same concepts of super insulated building envelope, windows, all electric heating and cooling. We actually have solar on all the rooftops.”

Jordi says that the recent distaste in Washington for green building is not expected to affect Tackenash.

Other amenities include a shared house with a community room, free wifi, bike racks and covered bike parking, and walkways through the grounds that connect to island trails. Tackenash Knoll is also integrated into other community resources; it is adjacent to the YMCA (and its associated ice rink), is across the street from Martha’s Vineyard Regional High School, and abuts a nature preserve.

Nicholson says the project qualifies as Transit Oriented Development, as one of the major bus routes on the island has a stop a few hundred feet away.

A Result of Fruitful Partnerships

Tackenash Knoll is the result of a three-year (so far) partnership between IHT and Affirmative. IHT began 19 years ago as a nonprofit homeownership developer, utilizing the benefits of ground leasing to allow low- and moderate-income families to become homeowners. They later became a Community Development Corporation, allowing the organization to develop rental housing as well, says Jordi.

When IHT heard about the towns of Oak Bluffs and Edgartown planning large affordable housing projects, it partnered with the larger Affirmative Investments in order to maximize project impact.

Jordi says the firm has been working on finishing Meshacket by the end of this year, with construction on Tackenash commencing this month.

The two projects combine add momentum to IHT’s larger work of providing a significant number of affordable units to Martha’s Vineyard. To date, the non-profit has completed over 170 units (both rental and ownership), with 130 more on the way.

That’s “a significant increase” in the rental supply on the island, Jordi says. “There’s just a significant disconnect between the increase in people’s income and what they can afford to purchase. (For a home) the gap now is some $900,000.” On the rental side, it’s a question of availability, Jordi says, because so many units are being turned into short-term rentals. “You actually can’t even find rentals here,” he says. “Thousands commute (from the mainland) on a daily basis.”

Some employers are providing housing to employees by purchasing existing homes or building new housing, he says. “I often say, if you don’t have housing in your business plan, you don’t have a viable business plan.”

Jordi anticipates no problem in filling the units. “We typically have ten people applying for each unit,” he says.

Affirmative is not the only fruitful partnership leveraged by IHT to provide Martha’s Vineyard with affordable housing units. MassHousing has also had “a longstanding relationship” with IHT, says Teden, furthering both organizations’ missions of high-quality, decent housing for all families. “There are 30 families living in their cars at any one time,” he says. “Some two bedroom apartments have six or eight people living in them. There’s just not enough housing lower-wage people can afford.”

Teden notes that MassHousing was involved in subsidizing the workforce housing aspect of the project, but did more than that, including a permanent mortgage. Still, “the workforce housing was a very significant piece.”

All in all there were 15 financing sources in the deal. “That’s what it takes nowadays,” Teden says.