Progress isn’t Linear

By Kaitlyn Snyder

4 min read

House passage of the reconciliation bill with three Low Income Housing Tax Credit provisions included is a significant win. Yet the successful implementation of these measures hinges on adequate appropriations for HUD programs.

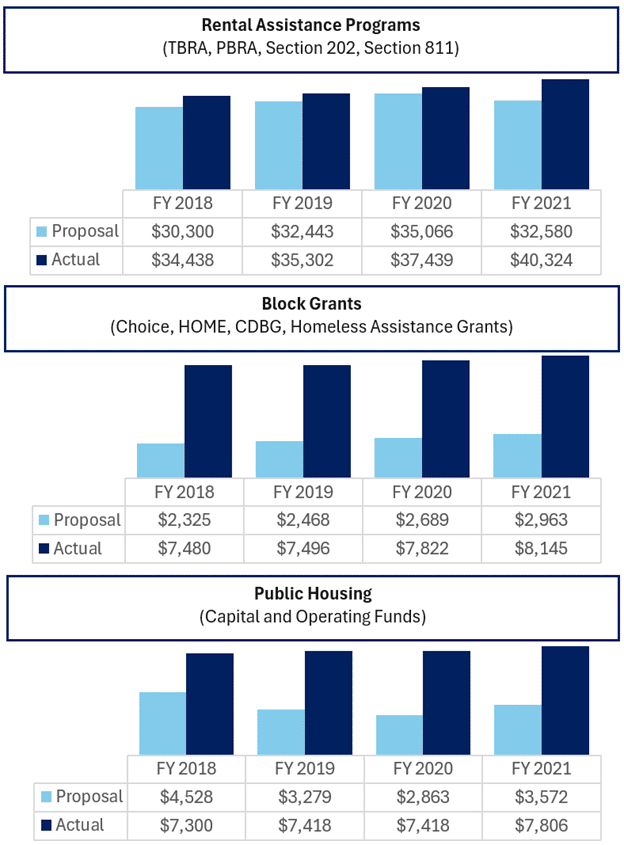

President Trump’s proposed FY 2026 skinny budget would slash HUD’s budget by 44 percent.

The proposed budget zeros out funding for critical gap funding programs, like HOME and Community Development Block Grants (CDBG), while proposing to cut $26.718 billion from rental assistance programs (Tenant-Based Rental Assistance, Public Housing, Project-Based Rental Assistance, Section 202 Housing for the Elderly, and Section 811 Housing for Persons with Disabilities) and block grant them to the states.

The 50 percent bond financed-by test reduction will allow affordable housing developments to use fewer tax-exempt bonds per deal, thereby allowing the scarce resource to stretch further across more deals. However, the reduction in tax-exempt bonds will need to be filled by something — be it recycled tax-exempt bonds, taxable bonds, gap funding, or additional debt.

- Recycled tax-exempt bonds are an excellent option for states that have warehouse facilities to take in and redeploy the recycled bonds within the required six-month time frame. States that have implemented bond recycling programs include California, Colorado, New York, Massachusetts, and Washington.

- Taxable bonds will likely fill the gap for many deals, though at a higher cost, thereby increasing the overall deal costs.

- President Trump’s proposed FY 2026 skinny budget would zero out the two primary federal sources of funding for gap funding – HOME and CDBG.

- State and local gap funding will play an even more important role under a reduced 50 percent test. The funding can take many forms, such as state housing tax credits, property tax abatements, allocations of state and national housing trust funds, etc.

- Many bond deals are already highly leveraged, taking additional debt off the table as an option.

The House-passed reconciliation bill includes language that would shift more Medicaid and food assistance responsibility to the states. Almost every state has a balanced budget requirement, and states will face significant budget challenges and likely reduce eligibility while implementing the newly required federal work requirements for those still able to receive Medicaid and food assistance.

For the housing world, that means state budgets will be stressed, with legislatures looking for cuts to maintain a balanced budget. State-level gap financing will likely be one of the first items cut, to say nothing of states being able to take on the rental assistance proposed by the administration’s skinny budget.

Housing projects rely on LIHTCs for the upfront construction costs and rental assistance to finance the ongoing operations. Adding more housing credits while slashing rental assistance is counterproductive to solving the nation’s housing shortage.

Please use this opportunity to thank your House representatives for passing the reconciliation bill that includes LIHTC provisions. While you have them on the phone (or email), tell them that the successful implementation of those provisions depends on robust funding for HUD programs, like rental assistance and gap financing. The federal government is the only entity poised to meet the scale of the national housing shortage — devolving that responsibility to the states is not a viable option.

The budget process will play out over the next several months. President Trump’s skinny budget is just one step, followed by a fuller administration budget proposal and proposals by both the House and Senate. President Trump proposed large budget cuts the last time he was in office, yet Congress maintained level funding.

We must make sure that is the case again and need your advocacy to ensure your federal elected officials know the importance of these programs. State elected officials also need to hear the importance of state-level funding for housing and know that cuts to achieve a balanced budget can’t come from housing programs.